Mastering Compliance: Best Practices for a Pain-free Annual Filing

As the CFO of every business knows, your annual filing is crucial for your business to stay compliant and in good standing with state authorities. Missed filing deadlines, outdated information, and incorrect reporting can result in costly penalties and damage your reputation, jeopardizing your ability to secure a loan, close contracts, or expand operations.

Completing your annual filing is a deeply collaborative process that requires considerable time and painstaking attention to detail for data validation and tag management. With multiple contributors working on your annual report, it can be challenging to effectively track workflows and maintain version control. Added to that, it’s a time-consuming and manual process that can be difficult to manage – integrating and validating data from multiple sources can eat up a lot of resources.

5 Best Practices for a Successful Annual Filing

- Get an early head start on your report – Don’t wait until the last minute to create and file your annual report. Create an easy-to-follow timeline for your annual filing process. Prevent penalties by tracking all filing dates and setting calendar reminders to ensure that no deadlines are missed. Define ownership of tasks, communication channels, and document templates.

- Foster strong collaboration practices – Establish open lines of communication to easily share updates and track progress, and promptly address concerns. Empower your team members with disclosure management tools that enable them to take ownership of their contributions and review audit trails to see who did what and when. Use strong access controls and single sign-on to ensure that only authorized users can change and approve the narrative.

- Prioritize quality control and internal review – Implement a robust internal review process before final report submission. Use a central repository for data gathering and reporting to avoid version control issues and implement workflow controls to streamline and expedite the production cycle. Check and recheck your XBRL tags to ensure accurate tagging. Conduct peer reviews, involve senior management, and leverage technology for data validation. Early identification and correction of errors saves time and avoids last-minute scrambling.

- Continually evaluate and refine your process – Learn from each filing cycle. Conduct post-filing assessments, identify areas for improvement, and adapt your procedures for next year. Use roll forward capabilities to automate the roll-forward process period-to-period, saving time and effort and eliminating manual processes and errors. Continuous improvement ensures efficiency and minimizes stress in future filings.

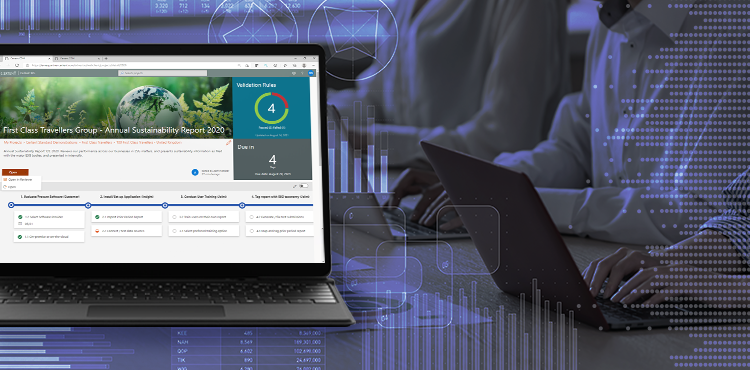

- Leverage technology for greater speed and accuracy – Implement industry-leading software, like Certent Disclosure Management from insightsoftware, to automate manual processes and reduce risk in your disclosure process. Disclosure management software allows you to directly connect to data from multiple sources, providing a single source of truth for consistent reporting. Real-time validation on XBRL documents allows you to instantly flag errors and improve overall quality in filings. Use the familiar Microsoft Office integration to work within the products you already know how to use, such as Word, Excel, and PowerPoint.

Best Practices for Annual ESMA Filings with CDM

Download NowSimplify and De-risk Your Annual Filing

By leveraging disclosure management software like Certent Disclosure Management to file your annual report, you’re able to bring speed, accuracy, and consistency to a laborious, error-prone, and difficult-to-control process. As the only all-in-one Microsoft-based disclosure management solution, Certent Disclosure Management streamlines and de-risks your annual filing in a way no other can.

- Automated Data Gathering: Streamline processes with automated data collection and aggregation and reduce the likelihood of errors associated with manual data entry.

- Deadline Tracking and Alerts: Stay on top of key filing deadlines, avoiding late submissions and associated penalties, with automated alerts and reminders.

- Regulatory Compliance: Ensure your annual reports comply with the latest regulatory requirements, reducing the risk of non-compliance and associated penalties.

- Data Accuracy and Audit Trail: Leverage audit trail features to trace changes and maintain a record of data modifications.

- Efficient Collaboration: Collaborate using standard Microsoft Office comments, enhancing communication and coordination between different teams and departments.

- Electronic Filing: Submit your annual reports electronically to relevant regulatory bodies; this not only expedites the filing process but also helps in maintaining a digital record of submissions.

Automated software like Certent Disclosure Management streamlines the annual report filing process, reduces the risk of errors, enhances regulatory compliance, and contributes to overall efficiency in managing disclosure reporting obligations. Investing in a solution like Certent Disclosure Management is your organization’s easiest way to make filing your annual report simple and painless. Read this whitepaper for tips on how to choose the right solution for your organization’s needs.