Where Does the Tax Department Fit in the Office of the CFO?

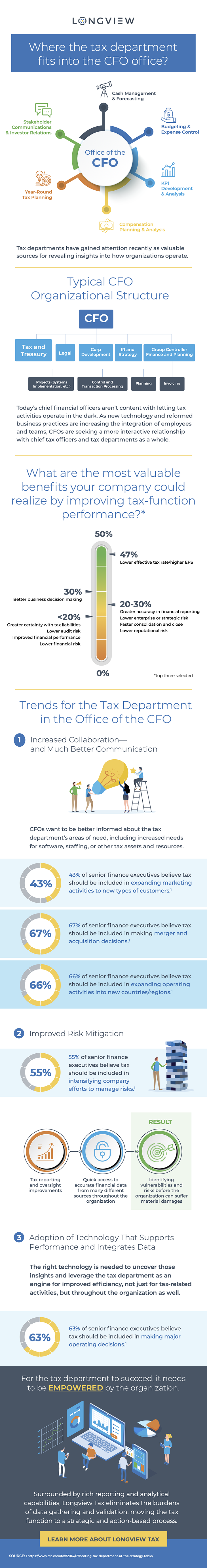

Tax departments may have operated in isolation in the office of the chief financial officer (CFO) in the past, but that’s changing at the enterprise level. Today’s CFOs aren’t content with letting tax activities operate in the dark. As new technology and reformed business practices are increasing integration of employees and teams, CFOs are seeking a more interactive relationship with chief tax officers and tax departments as a whole.

Although this can appear, at first blush, to be a meddling new development for tax leaders and their departments, an improved relationship with CFOs can offer value to tax departments as well. CFOs need to understand the value proposition of their own tax departments in order to communicate that value throughout the company.

To do that, the tax department needs to take a more prominent role within the office of the CFO. When this relationship is managed successfully, it increases the tax department’s value to the company while giving tax leaders a stronger voice in executive-level decisions.

Curious about how CFOs are changing their relationship with tax departments? Here’s a look at how enterprise-level CFOs are reshaping the role of tax in corporate finance.

Increased Collaboration—and Much Better Communication

One of the first steps CFOs are taking to change their relationship with tax departments is opening the lines of communication. Today’s CFOs are pushing chief tax officers to go beyond the traditional modes of communication, embracing this ongoing dialogue as an asset that will ultimately improve support for tax activities. In the end, this support will make life easier on the entire department.

Specifically, those CFOs want chief tax officers to embrace a “translation” approach to talking tax, breaking down complicated tax concepts and processes into a language that can be easily communicated to non-tax professionals, including executives and the company board.

According to Deloitte, CFOs also want to be better informed about the tax department’s areas of need, including increased needs for software, staffing, or other tax assets and resources.

Improved communication will improve the tax department’s transparency as a subset of corporate finance, and it will enable the CFO to provide the support needed to optimize tax operations in a way that maximizes their value.

Adoption of Technology That Supports Performance and Integrates Data

Tax departments have been slower than other business units to adopt new technologies that improve productivity and performance, according to Deloitte. But that’s gradually changing, in part due to better access to high-performance tools that can support tax activities at any scale.

CFOs want better oversight into technology as an asset that supports tax departments. They want to see how current technology is being utilized to ensure tax teams are making the most of the tools at their disposal. Through improved communication and a better understanding of business needs, those CFOs also want to help tax departments implement new technology that improves performance, reduces errors, and integrates data seamlessly to provide better insights into how tax activities can be improved throughout an organization.

Tax departments have gained attention recently as valuable sources for revealing insights into how organizations operate. The right technology is needed to uncover those insights and leverage the tax department as an engine for improved efficiency, not just for tax-related activities, but throughout the organization as well.

Improved Risk Mitigation

CFOs have a growing understanding of how tax departments can assist in risk mitigation across a range of financial activities. They’re seeking out ways to improve the tax department’s alignment with overall financial operations to manage risk and improve decision making at the company’s highest levels.

This improved risk mitigation can take several different forms. Tax-originated data can help identify and mitigate certain types of risk, including not just tax compliance matters but other financial practices as well.

But the benefits can extend even further, ensuring that other departments aren’t engaged in tax practices that run the risk of violating tax regulations or creating other unsafe financial situations.

Tax reporting and oversight improvements, as well as quick access to accurate financial data from many different sources throughout the organization, are essential to using tax departments to identify vulnerabilities and risks before the organization can suffer material damages.

Greater Visibility into Talent Development

Tax departments often face two challenges when it comes to developing in-house talent to take on new leadership roles.

First, tax leaders may advance a line of thinking that suggests they’re the only ones qualified to manage the tax department and pursue strategic goals set forth for the department. This can be an act of self-preservation in some cases, strengthening the leader’s value to the organization. But it can also be the product of not adequately developing talent to take on greater responsibility as advancement opportunities arise over time, according to The Wall Street Journal.

This talent development problem is compounded by a CFO’s lack of insight into how tax departments operate, and what is being done to groom talented professionals for future opportunities. When CFOs allow tax managers to run the department on their own, they create a situation in which the manager can eschew talent development—which benefits the organization but not necessarily the leaders in power—at the long-term expense of the company.

Consequently, CFOs are eager to gain more visibility into the tax department, as they would have with any other financial unit. By taking a more active role in talent development, they can make sure better succession plans are in place for the tax department.

Transformation That Adds Value to the Organization

Tax departments are no longer viewed by CFOs as a necessary cost of doing business. The expense might still be there, but there are opportunities to add value to an organization beyond simply preparing business taxes.

Today’s tax departments have an opportunity to undergo a restructuring that creates new ways to add value to an organization, increasing the ROI of this financial unit.

This doesn’t necessarily mean forcing tax departments to change the tasks they perform on a daily basis. The increased value is generated through the ways they approach and accomplish those tasks. In the case of tax preparation, this means using software that generates data and insights to enhance operations in the future—not just for the tax team, but also for other departments throughout the company.

Similarly, CFOs can change oversight and leadership practices to improve the alignment of strategy and operations for a tax department, ensuring that the objectives pursued by this financial unit are aligned with larger business goals.

By ensuring that productivity is providing direct service to an organization, tax departments can become more efficient while providing new support that increases ROI.

The Future of the Office of the CFO

As technology creates more interconnectedness within organizations, CFOs are using these new tools to bring themselves closer to the day-to-day operations of tax departments. CFOs want to know that chief tax officers are efficiently managing their departments and using leading tax solutions that support improved work and value-added transformation.

This transition can represent a culture shift for the tax department, but greater oversight and support from the CFO will only improve the tax department’s value to an organization.

And with the CFO’s improved understanding of a tax department’s needs and value, they can become a stronger advocate for tax activities when meeting with executive leaders.