Leveraging Microsoft Excel for Faster Monthly Closes and Ad Hoc Financial Reporting

For any dynamic organization, accurate and fast financial reports from ERP systems like Oracle E-Business Suite and SAP are critical to decision-making and strategy. Unfortunately, finance teams often find month-end closing, ad hoc analysis, reconciliations, and other reporting tasks time-consuming and frustrating because of the shortcomings of standard ERP reporting tools.

With standard ERP reporting tools, finance users often rely on IT programmers to extract data from the complex ERP base tables so they can format it in their tool of choice, Microsoft Excel. They may even find themselves re-keying a text dump from their system into Excel, which could introduce errors. Some tools, like Oracle’s Discoverer and SAP’s Report Painter and Report Writer, as well as some SAP transactions, provide an “Export-to-Excel” function. But the process still requires several steps and the data landing in Excel is static. All of these scenarios can introduce inaccuracies and add time to monthly closing, ad hoc, and other reports.

Excel-based financial reporting software for use with Oracle or SAP is a reliable way to circumvent the time-consuming processes imposed by standard ERP reporting tools. With this software, finance users can expedite the report creation and distribution processes, as well as access real time data in a dynamic, drillable format.

The Reality of Real-time Data

During monthly closes, accountants and financial analysts need a quick view of accurate data, trial balances, and last-minute journal entries in the General Ledger. Without access to real-time data, users are stuck going back through the many data extraction steps required by standard ERP reporting tools, delaying the close process. With Excel-based financial reporting tools that interface directly to the ERP system, analysts simply click to refresh reports that reflect new journal entries in the balances as soon as they post to the ERP system. Such capabilities can easily shave at least a day off the monthly close process, according to users of these reporting tools.

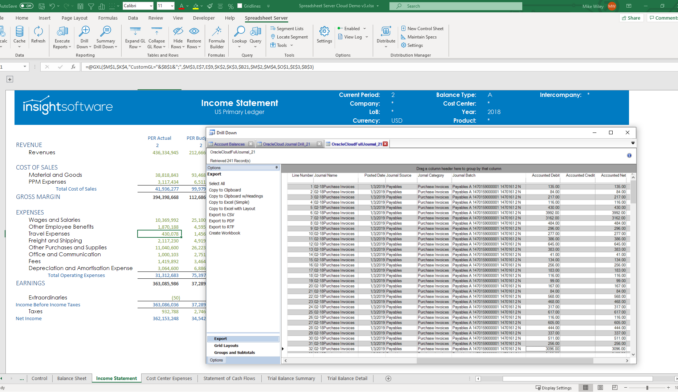

On the ad hoc reporting side, financial analysts rapidly build specialized reports using Excel formulas, IF statements, pivot tables, and VLOOKUP with an Excel-based reporting tool. Wizards and step-by-step instructions further expedite the process, and users can be confident in the real-time data because it comes directly from the ERP system. Users easily drill into the report to locate specific transactional information for managers waiting on their ad hoc requests.

Accounts Payable/Accounts Receivable (AP/AR) reconciliations are also efficiently executed using the drill down capability of an Excel-based reporting tool, which supports a deeper look into account details than standard, static ERP reports without such functionality. Users can pull one or more accounts, as well as account listings, so that AP and AR information is available in one drill down for an easy pivot off the information. Journal source and category sections in the criteria page allow drills into Sales invoices for a set time frame.

Consolidation and Report Distribution Efficiencies

With standard ERP reporting tools like Oracle’s Client ADI, users must individually open each report in the monthly financial package, then generate, refresh, and execute it. An Excel-based tool lets users consolidate this package into one Excel workbook with multiple tabs. The first tab is a control page where users change the time frame, choose Refresh All, and receive the entire updated monthly financial package, which is drillable to live data.

Another important aspect of reporting is the distribution process. Excel-based financial reporting tools allow users to create templates that execute financial reports and output them to a shared directory or email them to specified contacts. With a mouse click, monthly departmental reports are refreshed and emailed, automating the distribution process. Reports may be in a static format such as Excel, HTML or PDF so that managers can easily view them with no additional software, while those for some ERP systems can be in a refreshable Excel format that is password protected to ensure ongoing data integrity.

With Excel-based financial reporting tools, accountants and business analysts are empowered to create their own reports, which can be run with a simple click to retrieve up-to-the-minute data. These efficient reporting and distribution processes mean all involved—from Finance to mid- and upper-level management—have more time to analyze and react to critical business trends.

Interested in learning more? Download our Whitepaper: A Better Way to Conduct Month End